Mastering AI-Powered Product Research: A Beginner's Guide

Table of Contents

Introduction to AI-Powered Product Research

In today's competitive marketplace environment, finding profitable products is more challenging and more crucial than ever. Traditional product research methods often involve hours of manual competitor analysis, guesswork about market demand, and uncertainty around profit potential. Our AI-powered sales forecast tool changes this paradigm completely.

This guide will walk you through how to leverage our advanced AI technology to:

- Identify high-potential product opportunities before your competitors

- Accurately forecast sales volumes for new products

- Calculate realistic profit projections that account for all costs

- Understand market competition and demand trends

- Make confident, data-driven product decisions

Whether you're a new seller looking for your first product or an established merchant expanding your catalog, this guide will help you master the art and science of AI-powered product research.

Why AI-Powered Research Matters

Marketplace sellers who use data-driven product research are 3.5x more likely to launch successful products and achieve profitability within the first 90 days compared to those using traditional research methods.

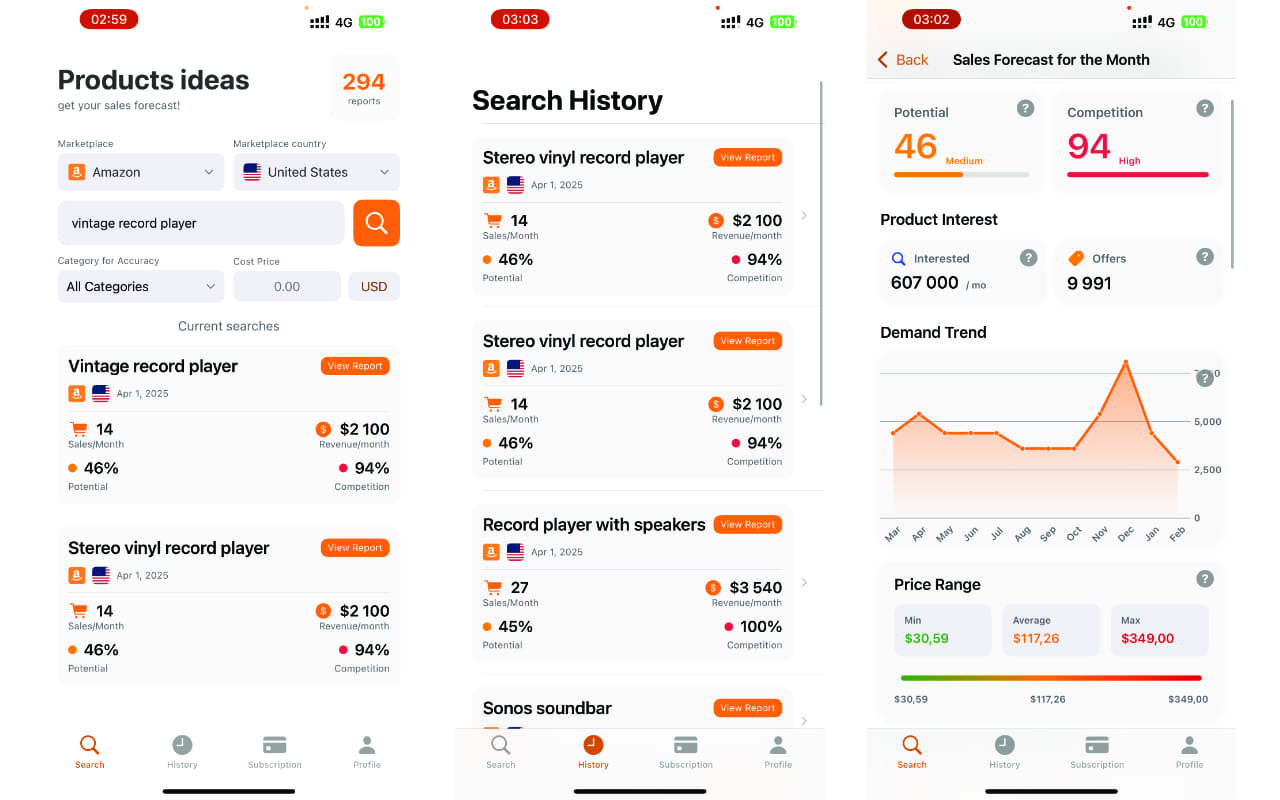

Getting Started with the App

Setting Up Your Account

Before diving into product research, ensure your account is properly set up with accurate information about your business. This helps our AI generate more precise forecasts tailored to your specific situation.

Complete Your Business Profile

Navigate to the Settings section and provide information about your business size, current marketplace presence, and product categories you're interested in. This helps customize your research experience.

Set Default Cost Parameters

Configure your default shipping costs, target profit margins, and other cost factors. These defaults will be applied to new product research unless you specify otherwise.

Connect Your Marketplace Account (Optional)

For established sellers, connecting your marketplace account allows our system to factor in your store's current performance metrics for more accurate projections.

Navigating the Dashboard

The dashboard provides a quick overview of your recent research activities and saved product ideas. Familiarize yourself with these key sections:

- Research Tab: Where you'll start new product research

- Saved Ideas: Access to your previously researched and saved product ideas

- Market Trends: Overview of trending categories and opportunities

- Research History: Complete log of your previous research sessions

- Settings: Account preferences and default parameters

The main dashboard provides quick access to your research tools and saved ideas.

Conducting Effective Product Research

The quality of your research results depends significantly on how you phrase your product ideas. Follow these best practices to get the most accurate forecasts:

Formulating Your Product Idea

Do:

- Be specific about the product type, features, and materials

- Use natural language as a customer would search

- Include key product attributes that affect pricing

- Specify target marketplace if you have a preference

Don't:

- Use broad category terms (e.g., "phone accessories")

- Include industry jargon customers wouldn't use

- Combine multiple product ideas in one search

- Include irrelevant details that might skew results

Examples:

| Poor Query | Better Query |

|---|---|

| "iPhone" | "iPhone 15 Pro Max silicone case with magsafe" |

| "Kitchen gadgets" | "Silicone garlic peeler and crusher with storage container" |

| "Fitness equipment" | "Adjustable ankle weights set 1-5lbs for women" |

Entering Product Details

After entering your product idea, you'll be prompted to provide additional details to improve forecast accuracy:

Specify Where You Plan to Sell

Select the target marketplace where you plan to sell this product. Each marketplace has different competition levels, fee structures, and customer behaviors.

Enter Cost Information

Provide your estimated cost price if you have it. This significantly improves profit projections. If you don't have this information, our system will estimate costs based on similar products.

Select Product Category

Choose the most specific category for your product. This affects fee calculations, competition analysis, and sales forecasts.

Pro Tip: Research Variations

Create multiple research queries for variations of your product idea with different features, price points, or target markets. This allows you to compare different approaches and find the optimal opportunity.

Understanding Key Metrics

Our AI analysis provides comprehensive metrics to help you evaluate product opportunities. Here's how to interpret the most important ones:

Monthly Sales Forecast

This represents the projected number of units you could potentially sell each month. It's calculated based on market demand data, competitive analysis, and historical marketplace patterns.

How to use it: Use this as your primary volume indicator and for inventory planning. Higher numbers indicate stronger demand, but always balance this against competition metrics.

Potential Monthly Profit

The projected net profit you can earn monthly after deducting all costs, including product cost, marketplace commissions, fulfillment, and estimated advertising costs.

How to use it: This is your bottom-line indicator. Compare potential profits across different product ideas to prioritize the most financially promising opportunities.

Potential

This score evaluates overall market opportunity based on search volume, competition index, monthly sales data, and supply-demand ratio. It weighs consumer interest against current market offerings.

How to use it: Look for products with high potential scores, which indicate strong demand relative to current market saturation essentially identifying gaps in the market.

Competition Level

Measures competition intensity by analyzing market saturation, maturity, and competitive density. It considers the relationship between search volume and current sales volume.

How to use it: Lower scores indicate less competition and potentially easier market entry. Balance this with demand metrics some competition validates market demand.

Demand Trend

Visualizes monthly search volume patterns for your product category, showing how consumer interest fluctuates throughout the year.

How to use it: Identify seasonal patterns and optimal launch timing. Look for products with stable or upward trends unless you're specifically targeting seasonal opportunities.

Price Range

Shows the minimum, average, and maximum prices of products in this category on the marketplace, helping you understand the pricing landscape.

How to use it: Identify pricing gaps in the market. Consider whether you can offer competitive value at a particular price point or if there's opportunity for premium positioning.

Holistic Analysis

No single metric tells the complete story. Always consider multiple metrics together to get a comprehensive understanding of the opportunity. A product with moderate sales forecasts but low competition and high margins might be more profitable than a high-volume, high-competition item.

Analyzing Research Results

Once our AI completes the analysis, you'll receive comprehensive results divided into several key sections:

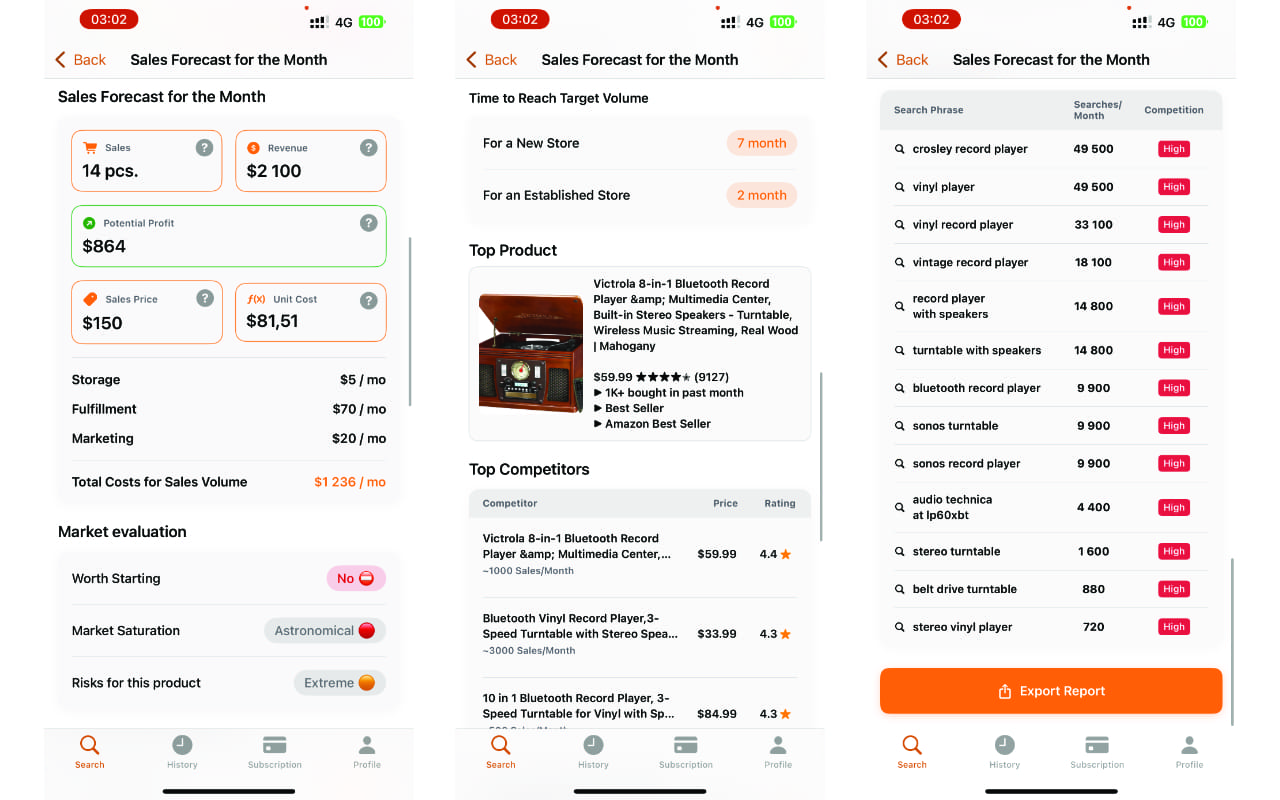

Sales and Profit Forecast Section

This section provides the financial outlook for your product idea:

- Monthly Sales: Projected unit sales volume

- Monthly Revenue: Expected gross income

- Potential Monthly Profit: Estimated net profit after all costs

- Recommended Price: Optimal selling price based on market analysis

- Total Costs of Sales: Breakdown of all expenses

Market Analysis Section

This section provides insights into the competitive landscape and market conditions:

- Potential Score: Overall opportunity rating

- Competition Level: Market saturation assessment

- Interested Users: Monthly search volume

- Marketplace Offers: Number of competing listings

- Demand Trend: Seasonal patterns and overall direction

Top Competitors Section

This section shows you who you'll be competing against:

- Competitor Listings: Top-performing products in your category

- Pricing Data: What competitors are charging

- Ratings and Reviews: Customer feedback metrics

- Estimated Monthly Sales: Performance of competing products

Keyword Analysis Section

This section helps you understand what customers are searching for:

- Recommended Keywords: High-value search terms

- Search Volume: Monthly searches for each keyword

- Competition Level: How competitive each keyword is

The comprehensive results dashboard provides all key metrics in an easy-to-interpret format.

Making Data-Driven Product Decisions

With your research results in hand, it's time to make informed decisions about whether to pursue this product opportunity. Here's a framework for evaluation:

The Decision Framework

1. Assess Market Viability

- Green Flags: High potential score, strong demand trend, moderate to low competition

- Red Flags: Declining demand trend, extremely high competition, limited search volume

Key Question: Is there sufficient customer demand and room in the market for a new entrant?

2. Evaluate Financial Potential

- Green Flags: Strong projected profits, healthy margins, reasonable time to target volume

- Red Flags: Razor-thin margins, high marketing costs, projected losses

Key Question: Will this product generate sufficient profit to justify the investment?

3. Consider Competitive Positioning

- Green Flags: Clear differentiation opportunities, gaps in the price range, weak competitor ratings

- Red Flags: Dominant competitors with strong reviews, saturated price points

Key Question: Can you offer something unique or better than existing options?

4. Assess Operational Feasibility

- Green Flags: Manageable inventory requirements, reasonable shipping costs, sustainable storage fees

- Red Flags: Excessive fulfillment costs, complex logistics, high return rates

Key Question: Can you effectively source, store, and fulfill this product at the projected costs?

Decision Categories

Pursue Now

The product shows strong potential across all key metrics with clear profit opportunity and manageable competition. These opportunities should move to your product development pipeline immediately.

Further Research

The product shows promise but has some concerning metrics or uncertainties. Consider refining the product concept, researching variations, or getting more precise cost information before deciding.

Monitor

The opportunity isn't ideal now but shows potential for the future. Save it to your dashboard to monitor how market conditions evolve over time.

Pass

The product shows significant red flags like high competition, low profit margins, or declining demand. Better to focus your resources elsewhere.

Pro Tip: Compare Multiple Ideas

Research several product ideas and compare them side by side using our comparison tool. This helps you allocate your resources to the most promising opportunities in your portfolio.

Common Mistakes to Avoid

Focusing Only on Sales Volume

High sales volume doesn't necessarily translate to high profits. Some high-volume products have thin margins and intensive competition. Always evaluate potential profit alongside volume metrics.

Ignoring Seasonality

Products with strong seasonal demand can be profitable, but you need to plan accordingly. Pay careful attention to the Demand Trend graph to identify and prepare for seasonal fluctuations.

Underestimating Costs

New sellers often focus on product and shipping costs while overlooking marketplace fees, returns, storage, and marketing expenses. Our Total Costs breakdown helps you avoid this by accounting for all cost factors.

Chasing Oversaturated Markets

Just because a product category is popular doesn't mean it's a good opportunity. Look for the sweet spot of healthy demand with manageable competition instead of diving into highly saturated categories.

Not Considering Differentiation

The Top Competitors section shows what's already on the market. If you can't identify a clear way to differentiate your offering (through features, quality, price, or branding), you may struggle to gain traction.

Next Steps

Once you've identified a promising product opportunity through your research, here's how to move forward:

Continuous Research Cycle

Product research isn't a one-time activity. Even after launching successful products, return to the research tool regularly to:

- Monitor changing market conditions for your existing products

- Identify complementary products to expand your line

- Discover new opportunity areas as your business grows

- Stay ahead of seasonal trends and shifting consumer preferences

Conclusion: Transforming Research into Success

AI-powered product research represents a significant competitive advantage in today's marketplace ecosystem. By leveraging data-driven insights rather than intuition alone, you can:

- Minimize risk by validating ideas before investing

- Identify high-potential opportunities others might miss

- Set realistic expectations for sales and profitability

- Plan your operations and marketing more effectively

- Build a strategic product portfolio aligned with market demand

The most successful marketplace sellers aren't necessarily those with the biggest budgets or the most experience they're the ones who make the most informed decisions. Our AI research tool puts that power in your hands, transforming complex market data into actionable insights that drive business growth.

As you become more familiar with the tool, you'll develop your own research workflows and decision criteria tailored to your specific business goals, risk tolerance, and market position. The key is to make product research a core part of your business process rather than an occasional activity.